You Can Give Your Child a Bright Future

It may be hard to believe, but someday your child will finish high school and head out into the world. You’ll want to be able to help them make the most of their future, and having funds for higher education will be a big part of that.

So. Portland

Open a NextGen 529 Account

And start investing in your child’s future.

What Is a NextGen 529 Account?

For College…

Plus a Whole Lot More

Jobs in the future will require some type of education after high school. NextGen 529 accounts do more than help you save for a four-year college education. They can be used to pay for two-year associate degree programs, vocational schools, trade schools, even qualified online courses—at home or abroad.

Trade School

Trade School

Tech School

Tech School

Private and Public School

Private and Public School

Apprenticeships

Apprenticeships

Home or Abroad

Home or Abroad

Online Courses

Online Courses

Books and Supplies

Books and Supplies

Room and Board

Room and Board

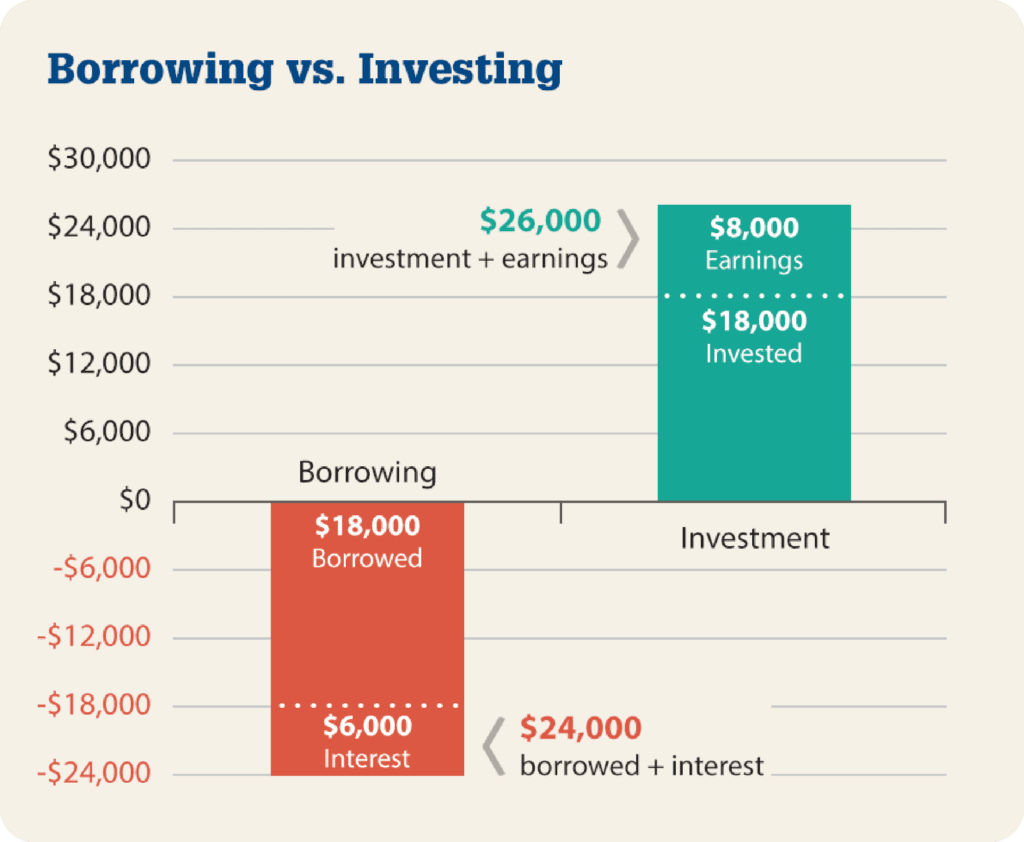

Investing or Borrowing?

What Makes the Best Fiscal Sense?

Every dollar in a NextGen 529 account is a dollar that doesn’t need to be borrowed (and repaid with interest) for education. And that can make a big difference.

This hypothetical investment example illustrates the potential value of regular $100 monthly investments over 15 years and assumes a $25 initial contribution and an average annual return of 5%. These examples do not reflect actual investments and do not reflect any fees or expenses. Investment performance is not guaranteed. Investments may lose value.

This hypothetical borrowing example illustrates the potential cost of borrowing $18,000, repaying over 15 years, and assumes an interest rate of 4%.

PROVIDE FOR THE FUTURE

3 Steps to Investing in Your Child’s Future

If you’re a Maine resident, there are hundreds of dollars in matching grants available.1 Here’s how to make the most of them.

Open a NextGen 529 Account

Begin by opening a NextGen 529 account for your child.

Receive a $100 Matching Grant

Open a NextGen 529 account with just $25 and automatically receive a $100 Initial Matching Grant!¹

If your baby got a $500 Alfond Grant2 at birth, you can use that to open a NextGen 529 account for your child without making an initial contribution—and your account will receive $100.

(Maine moms of children with an Alfond Grant, update your contact information so we can share information about the Alfond Grant with you.)

Add Money to Your Account

Contributing to your child’s NextGen 529 account can mean additional matching grants.

Receive NextStep Matching Grants

Contribute to your NextGen 529 account whenever you can and automatically receive 30% of your contribution amount in a NextStep Matching Grant—up to a $300 match per year!¹

Receive a $100 Automated Funding Grant

If you like the idea of building contributions into your budget, consider automatic funding from your payroll or bank account. When you set up and make six consecutive automatic contributions and get a $100 Automated Funding Grant.¹

Encourage Family and Friends to Contribute

NextGen 529 contributions make fantastic holiday, birthday, or “just because” gifts.

Receive NextStep Matching Grants

Grandparents, other family, or friends can all give to your account. Since gift contributions can be matched, you’ll receive a NextStep Matching Grant on their contributions—up to a $300 match per year.

Open a NextGen 529 Account

It’s a great way to start investing in your child’s future.

1Grants for Maine Residents are linked to eligible Maine accounts. An Alfond Grant recipient is eligible to receive the $100 Initial Matching Grant if the minimum required initial contribution is made before the beneficiary’s first birthday. Upon withdrawal, grants are paid only to institutions of higher education. See Terms and Conditions of Maine Grant Programs for other conditions and restrictions that apply. Grants may lose value.

2The Alfond Grant is not automatic in all circumstances and is also available in limited other circumstances. The use of the Alfond Grant is also subject to certain restrictions – see Alfond Grant Guidelines.

USRRMH0223U/S-2749464-1/1