COLLEGE SAVINGS GUIDE

Planning Ahead Makes All the Difference

Education after high school can open a world of possibility for you or your child. It can also seem a little overwhelming at times. To help you get started, we’ve pulled together a series of articles that will teach you the ins and outs of planning and paying for education after high school.

COLLEGE SAVINGS OPTIONS

From savings accounts to savings bonds to 529 plans, there are a variety of ways families save for college. Learn about the different ways to save for college.

EXPLORE OPTIONS ›

PLANNING FOR COLLEGE

College planning can be an exciting time for young people. It can also be a little overwhelming and stressful. Learn just what college—and planning for college—can mean.

MAKE A PLAN ›

PAYING FOR COLLEGE

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

HOW TO PAY FOR COLLEGE ›

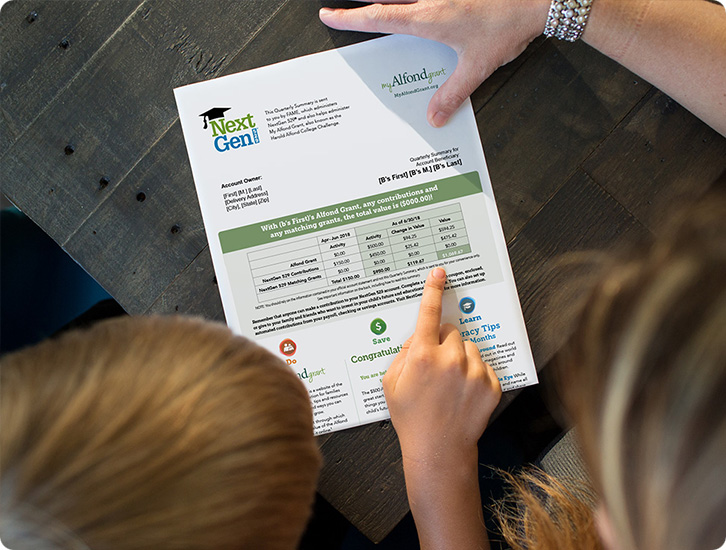

WHAT IS THE ALFOND GRANT?

The Alfond Grant can play an important role in saving and paying for your child’s higher education. Here we answer your questions about the Alfond Grant.

LEARN ABOUT THE GRANT ›

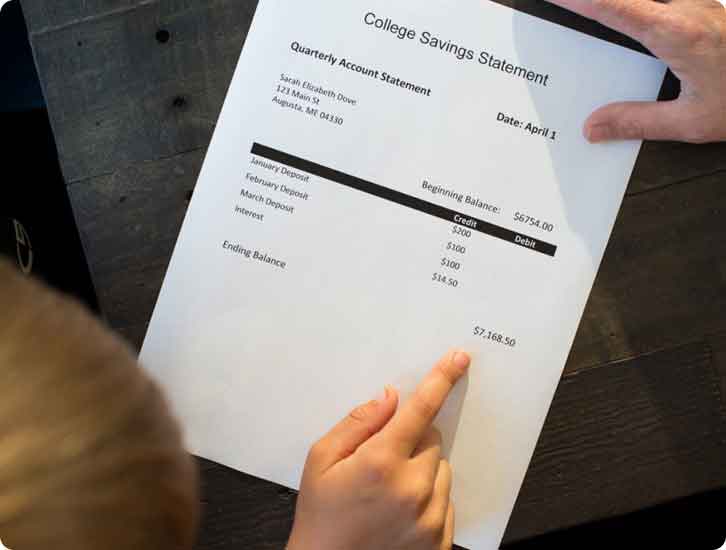

WHAT IS A 529 PLAN?

One tool families use to help pay for college is a 529 plan. We’ll show you the ins and outs of 529s to help you decide if it is something that’s right for you.

SEE IF A 529 PLAN IS RIGHT FOR YOU ›

College Savings & Market Volatility

You’ve taken the first step and decided to invest in your child’s future with Maine’s 529 college savings plan, which is designed to help you plan and pay for your child’s higher education.

READ MORE ›

Essential Calculators and Tools

Whether you’d like to see what your tax savings advantages could be with a NextGen 529 or how much you should save for your child’s college education, these tools will help.

READ MORE ›

GOALS-BASED BUDGETING

Retirement, college savings, emergency fund, college loans…with so many financial commitments, it can seem overwhelming. A great way to reach financial goals is to assign monthly income.

READ MORE ›

Using Your Alfond Grant

Here’s what you need to know about the Alfond Grant—and how to navigate the exciting path towards education after high school.

Learn More about how to use the Alfond Grant

Grow Your Maine Student’s Financial Capability

Resources to support Maine students on a path toward lifelong financial wellness.

Open a NextGen 529 Account

It’s never too early to start planning. Opening a NextGen 529 account now and saving can make a big difference to your child later.

USRRMH0824U/S-3799548