FAMILY OF ACCOUNTS

NextGen 529 Account Options

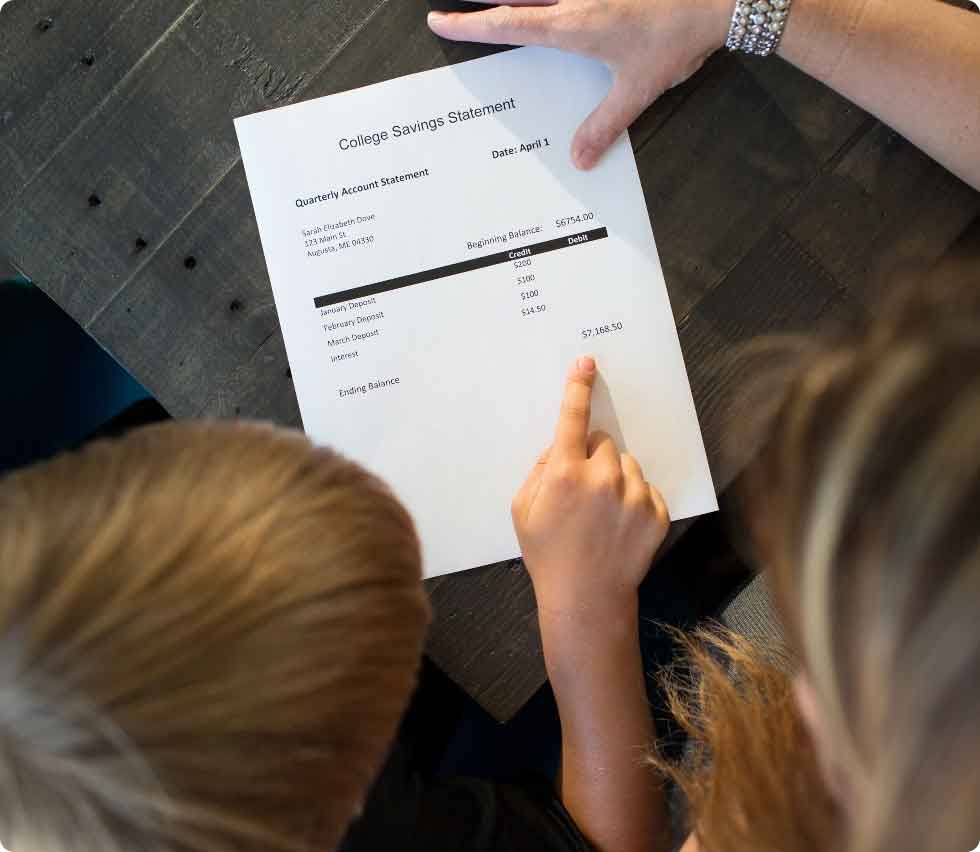

Investing in your child’s education after high school can open up so many possibilities for their future. Even small contributions can make a big difference—the good just adds up! It’s why we’ve created a family of accounts that let you save in a way that works best for you and your family.

NEXTGEN 529 AND YOU

The Power of Saving for Education

MORE JOB OPPORTUNITIES

Whether it’s college, trade school, or even qualified online courses, continuing education can open so many doors for your child – NextGen 529 can be used for all kinds of educational paths.

OPTIONS FOR THE FUTURE

None of us know what the future holds, so NextGen 529 accounts are designed to work for you. If your child doesn’t continue education after high school, you can use your funds for something else.

IT PAYS TO SAVE

It costs money to borrow money. So, every dollar in a NextGen 529 account is a dollar that doesn’t need to be borrowed (and repaid with interest) later. No matter your child’s age or grade level, every little bit helps prepare for their higher education expenses.

PLANS TO FIT YOUR PLANS

Three Great Ways to Save for Higher Education

NextGen 529 now gives you three types of accounts. You can choose what works best for your family!

Simplified Savings

The Connect Account

Connect Account Features:

- Streamlined investment choices

- Easy to view account platform

- Emergency savings option with Vestwell, managed on the same online platform

SELF-DIRECTED

The Direct Account

Direct Account Features:

- Multiple investment options

- Hands-on account control

- Self-directed savings choices

ADVISOR-MANAGED

The Select Account

Select Account Features:

- Multi-manager investment options

- Advisor and investor account platforms

- Advisor-managed savings choices

Compare Plans

Account Types

| Connect Simple and Streamlined | Direct Self-Managed | Select Advisor-Guided | |

|---|---|---|---|

| Description | The Connect Account has just one investment option at the time you open your account. After you open your account, an additional stable value option is available. Connect Account owners may also choose to open a separate emergency savings account with Vestwell that allows you to build savings and make withdrawals without the tax consequences of a 529 account.1 | The Direct Account offers several investment options, allowing you to build a college savings plan that works for your situation. | The Select Account offers the widest array of investment options, sold through financial advisors. A Select Account will allow your financial advisor to build a college savings plan that works for you. |

| Ideal For | Investors with limited experience seeking a straightforward approach with simplified choices. Already have a NextGen 529 account? You may want to use the same account type to manage all your accounts on one platform. | Self-directed investors who want hands-on control of their investment choices Already have a NextGen 529 account? You may want to use the same account type to manage all your accounts on one platform. | Investors who prefer personalized guidance from a financial advisor Already have a NextGen 529 account? You may want to use the same account type to manage all your accounts on one platform. |

Features & Options

| Connect Simple and Streamlined | Direct Self-Managed | Select Advisor-Guided | |

|---|---|---|---|

| Investment Options | Year of enrollment portfolios help make choosing your investment simpler. A Stable-Principal Savings Portfolio is available after you open your account. | 33 investment options, including Year of Enrollment Portfolios, Diversified Portfolios, and more. | 80 investment options, including multiple portfolio types managed by various fund managers |

| Emergency Savings Account | Yes – offered through Vestwell1 | No | No |

| Online/Mobile Tools | Managed on Vestwell Savers platform: check account value, make contributions, manage withdrawals | Managed on Merrill Edge® platform: check account value, make contributions, mobile app with Mobile Check Deposit | Managed on the Active Investor platform: check account value, make contributions, use gifting tools |

Cost & Requirements

| Connect Simple and Streamlined | Direct Self-Managed | Select Advisor-Guided | |

|---|---|---|---|

| Minimum to Open | $25 (Can be waived if automated funding/payroll deduction is established at account opening. Not required for accounts with an Alfond Grant) | $25 (Can be waived if automated funding/payroll deduction is established at account opening. Not required for accounts with an Alfond Grant) | $25 (Can be waived if automated funding/payroll deduction is established at account opening. Not required for accounts with an Alfond Grant) |

| Annual Asset-Based Fees | 0% – 0.29% | 0% – 0.56% | A Unit Class: 0.00% – 1.29% C Unit Class: 0.00% – 2.04% I Unit Class: 0.00% – 1.04% |

| How to Open | Open a Connect Account | Open a Direct Acount | Open with a Financial Advisor |

Why NextGen 529?

Higher education can lead to a better job and to better pay. A NextGen 529 account helps you save for your child’s education—and comes with a lot of benefits that can mean more opportunities for your child’s future.

Get Started

It’s never too early to start planning. Opening a NextGen 529 account now and saving can make a big difference to your child later. Choose the Account type that’s right for you to get started.

CUSTOMER SUPPORT

We’re Here to Help

- Have questions? You might find your answer on our FAQ.

- You can also check out our College Savings Guide,

- Contact Customer Service.

- Have questions about the $500 Alfond Grant or Grants for Maine Residents? Call FAME at 800-228-3734.

1The emergency savings account option is offered by Vestwell Trust Company, LLC and is (i) not a part of the NextGen 529 Program, (ii) not entitled to favorable tax advantages available to Participants in the NextGen 529 Program, and (iii) not affiliated with FAME.