COLLEGE SAVINGS GUIDE ARTICLES:

College Savings Options

When it comes to college savings, there are a lot of options to choose from. Some families open a savings account with their bank or credit union. Others may explore investing in a 529 plan or other investment vehicles.

How families choose to save is a personal choice with several factors such as budget, time until a child starts college, and personal attitude about financial risk all coming into play.

What’s most important, however, isn’t how you save for college, but that you save for college.

Why save for college?

College costs have increased dramatically in the last 30 years. Unfortunately, the financial aid available to students hasn’t kept pace with that increased cost.1 That means that many families can no longer rely solely on financial aid for covering the full cost of college. The truth is, many families pay for college using a variety of resources, such as:

- Financial aid and scholarships

- Grants

- Parent income

- Student income

- Student loans

- Parent savings

- Student savings

→ Most families don’t save enough to cover all college costs. Families pay for college using a piecemeal approach: grants and scholarships, income (parent and student), student loans, and savings.

Why saving for college is important

While savings isn’t the only way families pay for college, it is an important part.

By saving for college, families can:

Reduce future debt. That’s because every dollar saved can be used to pay directly for college and not be borrowed. And that can make a real difference in reducing future debt.

Increase the number of eligible college choices. Having funds you’ve saved or invested may allow your child to choose a college that may have been out of reach financially if you hadn’t done so.

Increase the likelihood your child will attend college. Children with college savings are seven times more likely to pursue higher education.2

Remember: Income is the primary factor in determining federal financial aid eligibility, not savings. So, if you hear you shouldn’t save for college because you won’t get financial aid, don’t listen—that’s wrong. The bigger risk is saving too little and not being able to pay.

→ Having even small amounts of savings gives students more options and helps them borrow less.

Different ways to save for college

Just as there are different types of colleges, there are also different types of college degree programs.

When it comes to saving for college, there’s no one right answer. What’s right is the plan that works for you, your family’s financial situation and your personal tolerance for risk. One family might choose a 529 plan, while another might choose a savings account at their credit union or bank, and yet another may choose a combination of both.

As you read through the different vehicles for college savings, remember that you can use more than one. You could choose to invest some money in a 529 plan to realize growth, but also put some in a savings account for flexibility. The choice is yours!

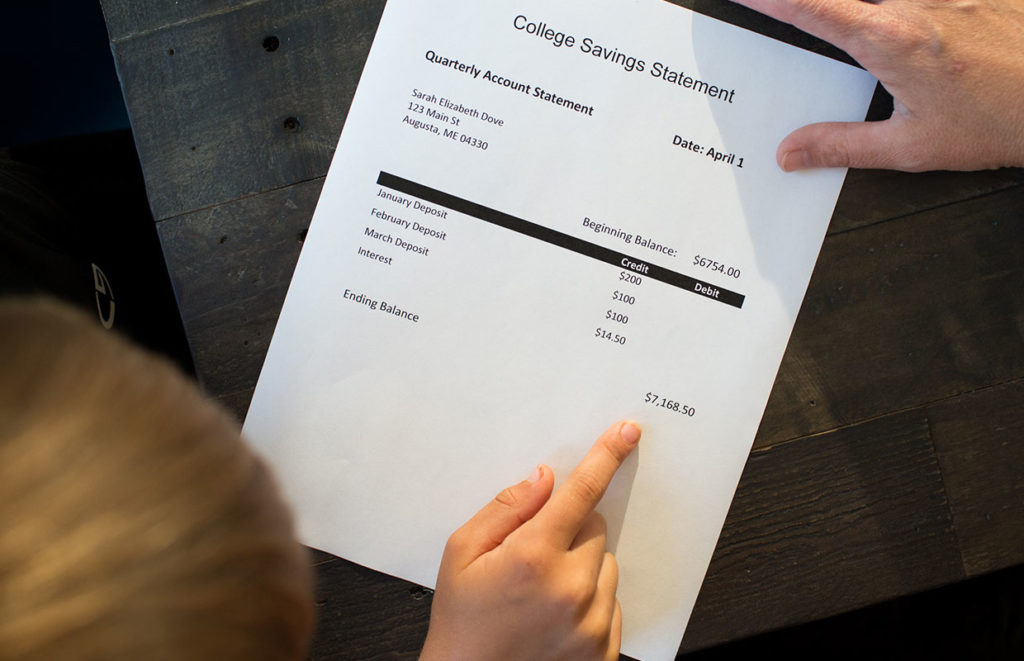

Savings Account

PROS

- It’s easy to open a savings account for college with whatever bank or credit union you already use for checking.

- Accounts can be attached to your regular checking or savings account, making it easy to contribute regularly.

- There are low (or no) fees associated with these accounts.

- Your money is safe with virtually no risk of loss.

CONS

- With lower interest rates, the interest realized on these accounts won’t keep up with inflation, reducing how much your money will buy.

- You could miss out on possible growth opportunities.

- No tax benefits.

U.S. Savings Bonds

U.S. savings bonds are backed by the federal government and may offer some benefits for college savers. Among other things, when you file the FAFSA, the bond is counted as an asset of the bond owner, who is typically the parent, and is therefore treated favorably in the federal formula that calculates the family contribution to a child’s education. See TreasuryDirect.gov for important information on using U.S. savings bonds for higher education expenses.

529 Plans

529 plans are tax-advantaged investing vehicles, designed specifically to help families plan for college expenses. 529 plans are sponsored by states, but investors are not limited to using the plan sponsored by their state. However, many states offer incentives to state residents to use their plan, such as tax deductions or matches to encourage contributions.

PROS

- Funds in a 529 plan can grow tax-free.

- Funds in 529 plans are invested, which allows the money in the account to have potentially higher returns, as opposed to only earning interest at a fixed rate.

- Withdrawals are tax-free when money is used to pay for qualified higher education expenses such as tuition, fees, room and board (when student attends at least half time), and books and supplies.

- Some states also offer a tax deduction or even a tax credit for money contributed to a 529 account. Visit https://www.merrilledge.com/college-savings/529-state-tax-calculator to find out which states offer a tax deduction/credit.

- Since 529s are specifically designed for college investing, many 529 plans offer investment options that automatically shift to lower-risk options as the student gets closer to enrollment to protect funds as the student nears college age.

- Recent legislation has increased flexibility for what 529 funds can be used. In addition to college, funds can also be used for K-12 secondary education, expenses associated with some apprenticeships, and even student loan repayment.

CONS

- Funds must be used for higher education. If the account owner withdraws money for another purpose, they will need to pay income taxes on any earnings and a 10% fee. However, if a student doesn’t need the money in a 529 account, the funds can be transferred to another family member, or, beginning in 2024, to a Roth IRA for the same student, under certain conditions.

→ How can I find a 529 account that is right for me? Visit Savingforcollege.com.

Coverdell Education Savings Accounts

A Coverdell Education Savings Account (Coverdell ESA) is a trust or custodial account set up solely for paying qualified education expenses for the designated beneficiary of the account. The funds are considered an asset of the parent when filing the FAFSA.

PROS

- Withdrawals are tax-free when money is used to pay for qualified higher education expenses such as tuition, fees, room and board (when student attends at least half time), and books and supplies.

- Assets in a Coverdell can be distributed to the child if not used for college.

- Funds may be transferred to another member of the beneficiary’s family.

CONS

- The maximum contribution amount per year is $2,000, and you can only add to the account until the child is 18.

- The ability to contribute phases out for high-income earners.

- Funds in the Coverdell must be withdrawn by the time the student is 30.

- Qualified higher education expenses don’t include apprenticeships or student loan repayment.

Uniform Gift to Minors Act (UGMA)/ Uniform Transfers to Minors Act (UTMA)

The UGMA and UTMA accounts are custodial accounts, which means they are investment accounts that legally belong to a child, allowing adults to transfer assets to, and manage investments for, a child.

PROS

- The adult retains control and management of the account until the child reaches the age of majority in their state.

- UGMA and UTMA accounts can be flexible: there are no income or contribution limits for UGMA/UTMA accounts and no penalties for early withdrawals. There are not restrictions on use of funds.

- These custodial accounts can be relatively easy to set up for a variety of assets or investments offered by financial institutions.

CONS

- When UGMA or UTMA accounts are used for college savings, the funds in the account are considered the child’s property, even if the child hasn’t reached the age of majority. That means when a family fills out the FAFSA, they must list UGMA and UTMA funds as the student’s assets, which are assessed at a higher rate than parental assets.

- Because UGMA and UTMA accounts legally belong to the beneficiary of the account, after the child comes of legal age, they get control of the account and can use the proceeds in whatever manner they wish.

Early Traditional and Roth IRA (Individual Retirement Account) Withdrawals

Individual Retirement Accounts (IRAs) are flexible retirement investments, as the funds can be used to pay for qualified higher education expenses. A traditional IRA is funded by pre-tax dollars, while a Roth IRA is funded by post-tax dollars.

PROS

- Both traditional and Roth IRAs allow you to withdraw money for qualified higher education expenses without penalty, under certain criteria.

- Early IRA withdrawals, before age 59 ½, are allowed without the 10 percent early withdrawal penalty, if funds are used for qualified education expenses.

- If money saved in an IRA isn’t used for higher education, it can be used for retirement.

CONS

- Withdrawals for qualified higher education expenses may still be taxed as ordinary income.

- Roth IRA funds can be withdrawn before 59 ½ only if the investment has been in for at least five years.

3 Tips to get you started saving for college

Saving for college is doable! What’s most important is that you save. Here are three tips to help you on your way.

Tip #1: Set a goal

Ask yourself what is a realistic goal for saving for college. You don’t have to save the full amount—maybe you commit to saving half or enough for one year. Once your child is old enough for a summer job, talk with them about what they can contribute.

- Be sure to consider your income. Prepare a budget and be realistic about how much you can set aside. You may be able to increase this as your earnings increase.

- And don’t forget your other saving needs as you come up with your college savings goal. Consider balancing saving for college with an emergency fund and saving for your retirement.

Tip #2: Make saving a habit

Make contributing to college savings as easy as possible. Think about:

- Signing up for automatic contributions.

- Saving on a schedule—maybe once a year (for example, at tax time if you receive a refund).

- Transferring a percentage of what you spent on your own student loans to college savings for your child.

- Transferring a percentage of what you spent on daycare to college savings.

Tip #3: Find money to save

Use “found” money to set aside for college savings.

- Create a budget and consider making saving for college a line item on the budget.

- Reduce household/personal expenses.

- As your income increases, increase your contributions to college savings.

- Use rewards programs (such as UPromise) or incentives offered by states/foundations to increase savings amounts. (NOTE: Maine’s NextGen 529 plan offers matched grants to Maine residents3 for saving in a NextGen 529 account. Some other states have matched funds or tax benefits.)

- Encourage gifts from family and friends to college savings accounts.

Having a college savings plan will ease your mind

When it comes to saving for college, the best thing you can do is just get started. It’s not so much how much you save that’s important, but that you save. Having even small amounts of savings gives students more options and helps them (and you) borrow less.

Remember, there’s no one right way to save for college. What’s right is the savings plan that works for you, your family’s financial situation, and your personal tolerance for risk.

- Ma, Jennifer, Matea Pender, and CJ Libassi (2020), Trends in College Pricing and Student Aid 2020, New York: College Board. © 2020 College Board.

- Elliott & Beverly, 2011. American Journal of Education.

- Grants for Maine residents are linked to eligible Maine accounts. Upon withdrawal, grants are paid only to institutions of higher education. See Terms and Conditions of Maine Grant Programs for details about eligibility and other conditions and restrictions that apply. Grants may lose value.

NextGen 529, FAME, its affiliates and employees do not provide tax, legal, investment, or accounting advice. This article is made available for general informational purposes only and is not a complete analysis of the subject discussed. Nothing contained in this material is intended to constitute tax, legal or investment advice, nor an opinion regarding the appropriateness of any investment. You should consult your own tax, legal, investment and/or accounting advisors before engaging in any financial transaction.

USRRMH0724U/S-3677052

Related Articles

PLANNING FOR COLLEGE

College planning can be super exciting for young people dreaming about what they’ll do with their lives. It can also be a little overwhelming and stressful.

APPLYING FOR FINANCIAL AID

Many families pay for education after high school by pulling from a variety of sources, and financial aid is an important part of that. This guide will help you through the application process.

PAYING FOR COLLEGE

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

Essential Calculators and Tools

Whether you’d like to see what your tax savings advantages could be with a NextGen 529 or how much you should save for your child’s college education, these tools will help.