COLLEGE SAVINGS GUIDE ARTICLES:

What Can I Use My 529 College Savings Account For?

A 529 college savings account is a powerful tool for supporting your child’s future, but its benefits extend beyond paying for traditional college tuition. Recent tax law changes have expanded the scope of eligible expenses, making 529 plans even more versatile. If you’re wondering what these funds can cover, the possibilities are broader than you might think, with flexibility for lots of educational paths.

A Foundation for Higher Education

At its core, a 529 plan is designed to cover the qualified expenses related for higher education. Tuition and fees at colleges, universities, qualified trade and career schools, and even some online programs are eligible and are among the most common uses. Whether your beneficiary is attending a bustling city campus or a specialized technical school, 529s can help cover these foundational expenses. Books, supplies, and equipment required for classes are also eligible. So, whether it’s a stack of engineering textbooks or a new set of culinary knives for a culinary arts program, your 529 savings have you covered.

→ For more on ways to use a 529, read How Can Grandparents Contribute to 529 College Savings Plans?

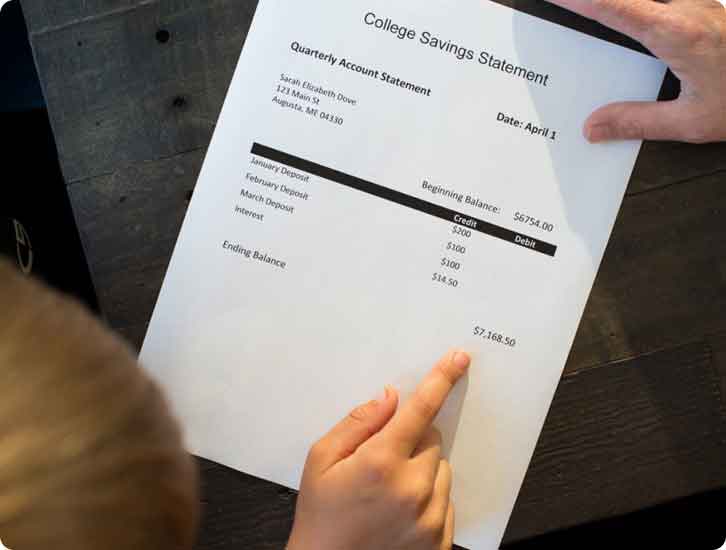

Benefits of Saving Calculator

When you save with a 529 plan, you’re not just setting money aside – you may decrease the amount you need to borrow. This calculator helps you explore how investing in a tax-advantaged 529 plan compares to a non-tax advantaged account. Plus, see the difference between saving in 529 plan now compares to borrowing and repaying with interest. If you’re a Maine resident, you can see the benefits of Maine Matching Grants, too.

Beyond the Campus Gates: Expanding Your 529 Plan’s Reach

While 529 plans have historically been associated with funding higher education, their utility has broadened significantly. Now, you can use your 529 plan to cover a range of educational costs, including:

K-12 Expenses You can allocate up to $20,000 annually per beneficiary towards tuition, curriculum, books, online educational materials, tutoring, testing fees, and education therapies for students with disabilities at an eligible elementary or secondary public, private, or religious school.1 This provides flexibility for parents seeking alternative educational options for their children.

Room and Board The costs of room and board at accredited colleges and universities can be substantial. Your 529 plan can help offset these expenses as long as the student is enrolled at least half-time, providing financial relief for students and families.

Trade and Career School Expenses For those pursuing technical or vocational training, 529 plans can be used to cover tuition, fees, and other associated costs at eligible institutions. This opens doors to a wide range of career paths, from skilled trades to healthcare professions.

Apprenticeships Expenses associated with an apprenticeship can be paid for with funds saved in a 529 account. The apprenticeship must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.

Educational Technology and Software In today’s digital age, access to technology is essential for academic success. Your 529 plan can be used to purchase laptops, tablets, software, and other educational technology tools).

Internet Access Reliable internet access is crucial for online learning, research, and communication. You can utilize your 529 plan to cover the costs of internet service for the student’s enrollment.

Study Abroad Programs Enriching cultural experiences and international education can broaden a student’s horizons. Your 529 plan can help fund study abroad programs, including tuition, fees, room, and board.

Special Needs Services 529 plans can also be used to cover expenses related to accommodating a beneficiary with special needs and their enrollment at an eligible institution, including specialized education, therapy, residential care, and medical equipment.

Qualified Post-Secondary Credentials Expenses associated with post-secondary credentialing can be paid for with funds saved in a 529 account. The credentialing program must be authorized under the Workforce Innovation and Opportunity Act (WIOA), a military credential, approved by the federal or state government, or aligned with other approved credential organizations.

Student Loan Payments Up to $10,000 529 plans can be used to repay eligible student loans of the beneficiary and the beneficiary’s siblings.

The Flexibility of 529 Plans

Life is full of surprises, and your child’s educational journey may take unexpected turns. Fortunately, 529 plans are designed to offer flexibility, allowing you to adapt to changing circumstances.

For example, if plans change, you can update the beneficiary of the 529 plan to another eligible family member or even yourself!2

In addition, recent tax law changes allow you to utilize some unused 529 funds for retirement planning through a rollover to a Roth IRA. Learn more NextGen 529 Roth rollovers.

A Note of Caution on Non-Qualified Expenses

While 529 Plans are versatile, they do have boundaries. To access all tax benefits, you should use funds from a 529 account for qualified educational expenses.3 Expenses like transportation, health insurance, and general living costs are not considered qualified and would incur income tax on the earnings plus a 10% federal penalty if withdrawn.

However, there are exceptions to the penalty, for example if the student receives a scholarship or attends a qualifying military academy. Learn more about other exceptions in the NextGen 529 Program Descriptions. Planning withdrawals carefully and documenting all eligible expenses is essential to avoid unexpected costs.

Tailored Benefits for Maine Residents

For Maine residents, the NextGen 529 plan offers unique advantages, including matching grants that can significantly enhance your savings. Eligible families can receive up to a 30% match on annual contributions, plus additional grants for setting up automatic deposits or saving consistently—making it an even smarter way to save for education.

→ Check out unused 529 funds options at What Happens to My 529 if My Child Doesn’t Go to College?

A Partner in Education

Opening a 529 account is more than just a financial strategy—it shows your commitment to your loved one’s educational journey. Whether it’s funding traditional college, a hands-on apprenticeship, or private schooling, a 529 Plan can adapt to support diverse ambitions. By understanding the breadth of what a 529 account can cover, you can make informed decisions to ensure your savings align with your family’s educational goals.

Start saving early, make contributions regularly to your 529 account, and consult your plan’s guidelines or a financial advisor to make the most of this opportunity. Education is an investment, and with a 529 account, the returns can last a lifetime.

- While Maine considers K-12 expenses a qualified expense for state tax purposes, other states may treat withdrawals from a 529 for K-12 expenses differently. Please consult your tax advisor for specific advice about such withdrawals. ↩︎

- Some restrictions apply. You generally are permitted to change the beneficiary to another qualified member of the family, as defined under the Internal Revenue Code, without triggering income tax and 10% additional federal tax. Not applicable for accounts opened under a Uniform Gifts/Transfers to Minors Act registration (UGMA/UTMA). ↩︎

- To be eligible for favorable tax treatment afforded to any earnings portion of withdrawals from Section 529 accounts, such withdrawals must be used for qualified higher education expenses, as defined in Section 529 of the Internal Revenue Code. Any earnings withdrawn that are not used for qualified higher education expenses are subject to federal income tax and may be subject to a 10% additional federal tax as well as state and local income taxes. State tax treatment of distributions for certain qualified higher education expenses may differ. Please consult your tax advisor for specific advice regarding such distributions. ↩︎

Related Articles

PLANNING FOR COLLEGE

College planning can be super exciting for young people dreaming about what they’ll do with their lives. It can also be a little overwhelming and stressful.

MAKE A PLAN ›

COLLEGE SAVINGS OPTIONS

From savings accounts to savings bonds to 529 plans, there are a variety of ways families save for college. Learn about the different ways to save for college.

EXPLORE OPTIONS ›

PAYING FOR COLLEGE

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

HOW TO PAY FOR COLLEGE ›

529 Planning Calculators

Whether you’d like to see what your state’s tax benefits could be with a 529 plan or make a plan to meet your savings goals, these calculators can help you learn more.