COLLEGE SAVINGS GUIDE ARTICLES:

Is There a Tax Deduction for Putting Money Into My 529 College Savings Plan?

Investing in a 529 college savings plan can be a smart way to save for education costs, offering both federal and state-level tax advantages. While the federal government does not provide a tax deduction for contributions to a 529 plan, many states, including Maine1, offer incentives to encourage participation. These state-level benefits can enhance the value of your contributions and are worth exploring.

Federal Tax Benefits

Although contributions to a 529 plan are not tax-deductible on your federal tax return, the federal tax advantages lie in how the funds can possibly grow and are eventually used. Contributions can grow tax-deferred, meaning you won’t pay taxes on the investment earnings each year. When the money is withdrawn for qualified educational expenses, such as tuition, room and board, or textbooks, it is tax-free.

→ For more on ways to use a 529, read What Can I Use My 529 College Savings Plan For?

This combination of tax-deferred growth and tax-free withdrawals offer a substantial benefit over time, especially if you start contributing early and allow the account to benefit from compounding. Additionally, there are no annual income limits for contributing to a 529 plan, making it a widely accessible savings tool.

State-Level Tax Deductions and Credits

At the state level, Maine and many other states offer tax incentives to residents who contribute to their own state’s 529 plan.

Maine Tax Deductions

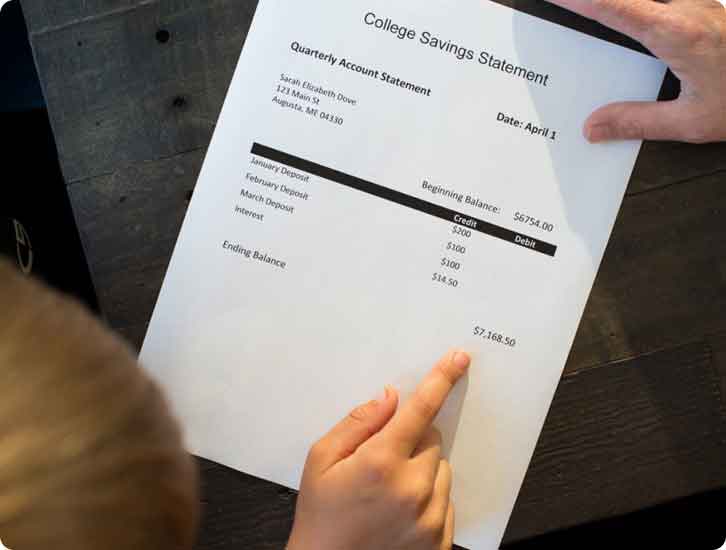

Maine allows taxpayers to deduct a portion of their contributions to 529 college savings plans from their state income taxes. Specifically, Maine residents can deduct up to $1,000 per beneficiary annually by December 31st for contributions made to any qualified 529 plan, regardless of the state sponsoring the plan.2

However, there are income limits for this deduction. It is available only to individuals with a federal adjusted gross income (AGI) of $100,000 or less for single filers (or those married filing separately) and $200,000 or less for married couples filing jointly or heads of household. Contributions exceeding these income limits do not qualify for the state tax deduction.

If you are a Maine taxpayer planning to leverage this benefit, it’s essential to keep track of contribution amounts and verify the AGI thresholds to ensure eligibility.

529 Plan State Tax Deduction Calculator

Depending on your 529 plan, you may be eligible for a state tax deduction when you contribute to a 529 plan—and this calculator can help you estimate what that might look like for you. See how your contributions this year could translate into tax savings, making it easier to invest in your student’s education while benefiting at tax time.

State-Specific Rules to Consider

While the tax advantages are enticing, it’s important to note a few caveats:

In-State Plans vs. Out-of-State Plans: Some states require you to invest in their specific 529 plan to qualify for tax benefits, while others provide tax deductions regardless of which state’s plan you use. Maine offers a state income tax deduction for contributions to any 529 plan, not just the NextGen 529 plan. This means you can choose a 529 plan offered by any state, including Maine, and still be eligible for the Maine state tax deduction.

Remember, the NextGen 529 plan is Maine’s official 529 plan and offers additional benefits for Maine residents, such as savings matches in the form of the Grants for Maine Residents program. It’s always a good idea to research different 529 plans to determine which one best helps you meet your specific needs and financial goals.

Maximizing the Tax Benefits

To fully leverage the tax benefits of a 529 plan, consider the following strategies:3

- Start early: The earlier you start investing in a 529 account, the more time it has to possibly add up and grow. And that growth is tax-free when used for qualified higher education expenses.

- Contribute Regularly: Consistent contributions, even small ones, can help you find money in your budget to maximize state tax deductions or credits. Many plans allow you to set up automatic contributions, simplifying the process.

- Coordinate with Family Members: Grandparents or other family members can also contribute to any 529 account, potentially qualifying for their own Maine state tax benefits, depending on their eligibility.

→ For more on ways to use a 529, read How Can Grandparents Contribute to 529 College Savings Plans?

Special Gifting Opportunities

Beyond regular contributions, 529 plans also offer unique tax advantages for gift contributions. You can contribute up to $19,000 per year ($38,000 for couples) without incurring federal gift taxes. Alternatively, you can use the “super funding” provision to contribute up to five years’ worth of gifts at once—$95,000 for individuals or $190,000 for couples—without triggering federal gift taxes. Keep in mind, there is an aggregate account balance limit of $545,000 per Designated Beneficiary (subject to adjustment periodically).4

This strategy not only maximizes the tax-deferred growth of the plan but also may help reduce the size of your taxable estate. You should consult a tax advisor before gifting to any 529 plan.

Consult State-Specific Resources

Wondering if your state offers a tax benefit for 529 plan contributions? Check out this state-by-state list. A financial advisor or tax professional can also help you evaluate which plan aligns best with your goals, taking into account any tax benefits and investment options.

The Bottom Line

While the federal government doesn’t offer a direct tax deduction or credit for 529 contributions, the tax advantages at the state level, combined with the benefits of tax-deferred growth and tax-free withdrawals, make 529 plans a powerful tool for education savings. By understanding your state’s rules and maximizing these incentives, you can make a significant impact on your loved one’s educational future while reaping meaningful tax savings along the way.

- Availability of the state tax deduction is subject to federal adjusted gross income limits. See NextGenforME.com/essential-calculators-tools and consult your tax advisor. ↩︎

- To be eligible for favorable tax treatment afforded to any earnings portion of withdrawals from Section 529 accounts, such withdrawals must be used for qualified higher education expenses, as defined in Section 529 of the Internal Revenue Code. Any earnings withdrawn that are not used for qualified higher education expenses are subject to federal income tax and may be subject to a 10% additional federal tax as well as state and local income taxes. State tax treatment of distributions for certain qualified higher education expenses may differ. Please consult your tax advisor for specific advice regarding such distributions. ↩︎

- Although FAME provides information about NextGen 529, FAME does not provide legal, tax or accounting advice. The information provided on the NextGenForMe.com website should not be relied upon for the purpose of tax planning or avoidance of any tax penalties that may be imposed under the Internal Revenue Code or applicable state of local tax law provisions. You should consult your tax and/or legal advisors before making any financial decisions. ↩︎

- If you make the five-year election to prorate a lump-sum contribution that exceeds the annual federal gift tax exclusion amount and you die before the end of the five-year period, the amounts allocated to the years after your death will be included in your gross estate for tax purposes. Please note that when making a contribution to a 529 account (whether for a single year or using the special election to prorate the gift over five years), all other gifts you make to a particular beneficiary are included in determining the available annual gift exclusion amount. ↩︎

Related Articles

PLANNING FOR COLLEGE

College planning can be super exciting for young people dreaming about what they’ll do with their lives. It can also be a little overwhelming and stressful.

MAKE A PLAN ›

COLLEGE SAVINGS OPTIONS

From savings accounts to savings bonds to 529 plans, there are a variety of ways families save for college. Learn about the different ways to save for college.

EXPLORE OPTIONS ›

PAYING FOR COLLEGE

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

HOW TO PAY FOR COLLEGE ›

529 Planning Calculators

Whether you’d like to see what your state’s tax benefits could be with a 529 plan or make a plan to meet your savings goals, these calculators can help you learn more.