COLLEGE SAVINGS GUIDE

Planning Ahead Makes All the Difference

Education after high school can open a world of possibility for you or your child. It can also seem a little overwhelming at times. To help you get started, we’ve pulled together a series of articles that will teach you the ins and outs of planning and paying for education after high school.

COLLEGE SAVINGS OPTIONS

From savings accounts to savings bonds to 529 plans, there are a variety of ways families save for college. Learn about the different ways to save for college.

EXPLORE OPTIONS ›

PLANNING FOR COLLEGE FOR MAINE STUDENTS

College planning can be an exciting time for young people. It can also be a little overwhelming and stressful. Learn just what college—and planning for college—can mean.

MAKE A PLAN ›

PAYING FOR COLLEGE FOR MAINERS

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

HOW TO PAY FOR COLLEGE ›

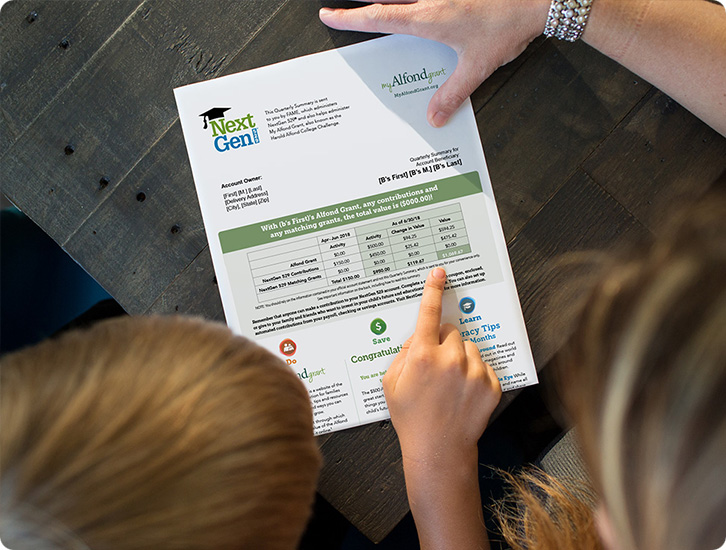

WHAT IS THE ALFOND GRANT?

The Alfond Grant can play an important role in saving and paying for your child’s higher education. Here we answer your questions about the Alfond Grant.

LEARN ABOUT THE GRANT ›

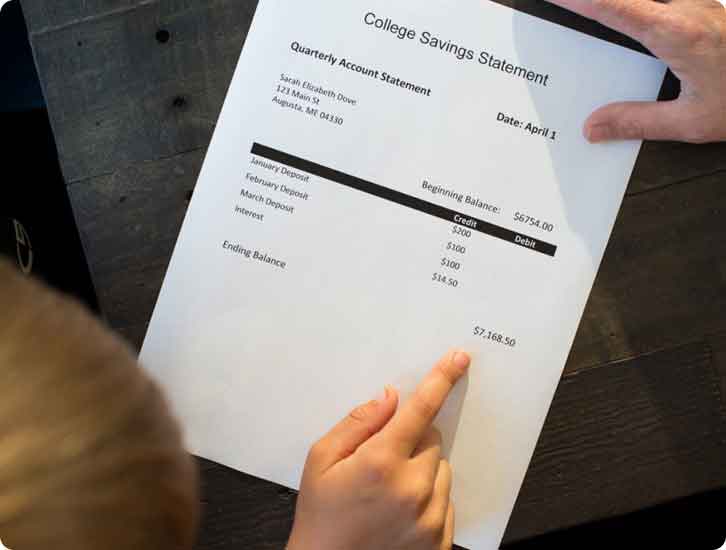

WHAT IS A 529 PLAN?

One tool families use to help pay for college is a 529 plan. We’ll show you the ins and outs of 529s to help you decide if it is something that’s right for you.

SEE IF A 529 PLAN IS RIGHT FOR YOU ›

College Savings & Market Volatility

You’ve taken the first step and decided to invest in your child’s future with Maine’s 529 college savings plan, which is designed to help you plan and pay for your child’s higher education.

LEARN SAVINGS & MARKET VOLATILITY ›

Essential Calculators and Tools

Whether you’d like to see what your tax savings advantages could be with a NextGen 529 or how much you should save for your child’s college education, these tools will help.

EXPLORE SAVINGS TOOLS ›

GOALS-BASED BUDGETING

Retirement, college savings, emergency fund, college loans…with so many financial commitments, it can seem overwhelming. A great way to reach financial goals is to assign monthly income.

EXPLORE BUDGET TIPS ›

Using Your Alfond Grant

Here’s what you need to know about the Alfond Grant—and how to navigate the exciting path towards education after high school.

Learn More about how to use the Alfond Grant ›

What Happens to My 529 if My Child Doesn’t Go to College?

Plans for your child’s future can change. If your child decides to not go to college, you have options for how to use your 529 plan funds. Learn more about options for unused 529 funds.

KNOW YOUR OPTIONS ›

What Can I Use My 529 College Savings Plan For?

For college and so much more! If you’re wondering what 529 college savings funds can be used for, the possibilities are broader than you might think.

SEE WHAT’S COVERED ›

Is There a Tax Deduction for Putting Money into My 529 College Savings Plan?

529 college savings plans offer both federal and state-level tax advantages. Find out what tax benefits you could receive.

UNLOCK TAX BENEFITS ›

How to Apply for College Financial Aid: A Simple Guide

Learn how to apply for college financial aid with FAFSA tips to help you maximize eligibility and make college more affordable.

GET STARTED WITH FINANCIAL AID ›

How Can Grandparents Contribute to 529 College Savings Plans?

Grandparents can support their grandchildren’s future education with contributions to a 529 college savings plan. Find out how grandparents can contribute to a 529 plan.

MAKE A LASTING IMPACT ›

Which 529 Account Is Right for You?

NextGen 529 offers three types of accounts

Simplified Savings

The Connect Account

Connect Account Features:

- Streamlined investment choices

- Easy to view account platform

- Emergency savings option by Vestwell, managed on the same online platform

SELF-DIRECTED

The Direct Account

Direct Account Features:

- Multiple investment options

- Hands-on account control

- Self-directed savings choices

ADVISOR-MANAGED

The Select Account

Select Account Features:

- Multi-manager investment options

- Advisor and investor account platforms

- Advisor-managed savings choices

Grow Your Maine Student’s Financial Capability

Resources to support Maine students on a path toward lifelong financial wellness.