COLLEGE SAVINGS GUIDE ARTICLES:

How to Manage Market Volatility in Your NextGen 529 Account

Quick changes in the market and the resulting changes to your 529 account value can feel like an emotional roller coaster—even for the most experienced investors. The good news? NextGen 529 has options to help you navigate market volatility with confidence. Keep reading for help navigating this tricky subject.

Riding Out Market Ups and Downs

We know you don’t have the power to predict or control the markets and economy. However, you do have the power to control how much you save and the diversification of your investments. When market values take a dip, having sound 529 plan risk management strategies in place can make all the difference.

Diversification & Rebalancing

Diversification means not putting all your eggs in one basket—you spread your money across different types of investments to help reduce risk. Rebalancing is like a regular check-up for your portfolio, making sure everything stays in line with your goals. Both are ways to help keep investments on track and manage risk over time.

Dollar Cost Averaging Can Help

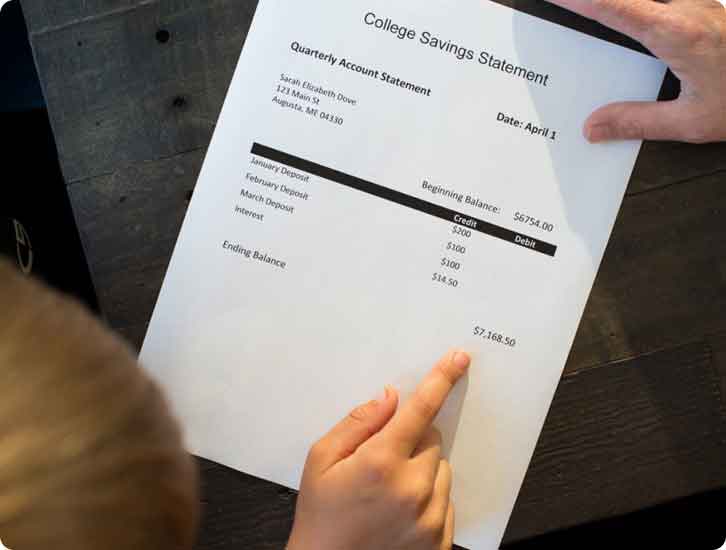

Many parents find that dollar cost averaging1 in 529 plans brings peace of mind during market uncertainty. This simply means making consistent contributions on a regular schedule, regardless of market conditions. When prices drop, your contribution buys more shares; when prices rise, you purchase fewer. Over time, this approach can help smooth out the effects of market swings and potentially lower your average investment cost.

Align Your Strategy to Meet Your Goals

Consider periodically assessing your investment choices with your time horizon, risk tolerance, and investment objectives in mind. NextGen 529 gives you flexibility—you can change existing investments twice yearly and adjust future contributions anytime. Making use of these options can help you keep your investments aligned with your goals.

Goal Setting Calculator

Setting your college savings goal doesn’t have to be complicated. Use this calculator to explore different savings goals and see how they might help you build toward your student’s future. Set a goal that feels right for you—whether it’s covering a portion of costs or aiming for more. Every dollar in a NextGen 529 account is a dollar that doesn’t need to be borrowed (and repaid with interest) later.

How Can I Protect My Investment Right Now?

- I have a Select Account – This is a great time to speak with your advisor. The Client Select Series has a wide array of investment choices to allow you and your advisor to customize a plan to work best for you.

- I have a Direct Account – Consider reviewing your account to make sure your investments are adequately diversified to meet your investment objectives. If you wish to change your existing investments, please review the Client Direct Series Program Description and the Client Direct Investment Change Form.

- I have a Connect Account – If your investments are in a Year of Enrollment Portfolio, check that the portfolio name reflects the year closest to the time you anticipate using the funds for the first time.

Are There Any Investment Options That Are FDIC Insured?

Yes! Check out the NextGen Savings Portfolio. It’s an FDIC-insured option for savers seeking stability during market volatility. Existing investments can be changed up to 2x per year, and future contributions can be changed at any time.

What If My Matching or Alfond Grant Values Decrease?

Great question. All grants are invested and will experience changes in value over time. Alfond Grants are owned and invested by the Alfond Scholarship Foundation. Maine Matching Grants are owned and invested by FAME. Plan to check the value of grants next quarter to see and monitor changes.

The Bottom-Line: Focus On Long-Term Strategy

It’s natural to feel uneasy when markets are unpredictable—but letting short-term emotions drive your decisions can lead to missed opportunities in the long run. A well-considered investment strategy and a steady approach can offer a sense of stability during uncertain times.

History shows that parents and grandparents who stay focused on their long-term education savings goals and implement long-term strategies for 529 plan growth are often better positioned to benefit when markets recover. While no one can predict exactly what will happen, keeping your eyes on the big picture can give your student a stronger chance at a future with less student loan debt.

With a NextGen 529 account, setting up regular contributions—even in small amounts—can go a long way over time. It’s a simple step that may add up to big savings down the road.

1Dollar cost averaging and other periodic investments do not ensure a profit and do not protect against loss in declining markets. Such a plan involves continuous investment in securities, regardless of fluctuating price levels of such securities. Investors should consider their financial ability to continue their purchases through periods of high or low price levels.

Related Articles

COLLEGE SAVINGS OPTIONS

From savings accounts to savings bonds to 529 plans, there are a variety of ways families save for college. Learn about the different ways to save for college.

APPLYING FOR FINANCIAL AID

Many families pay for education after high school by pulling from a variety of sources, and financial aid is an important part of that. This guide will help you through the application process.

PAYING FOR COLLEGE

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

529 Planning Calculators

Whether you’d like to see what your state’s tax benefits could be with a 529 plan or make a plan to meet your savings goals, these calculators can help you learn more.